Acting on Client Feedback

Industry best practices have been shown to improve financial services and ensure they are effective, fair and transparent. See below for more details.

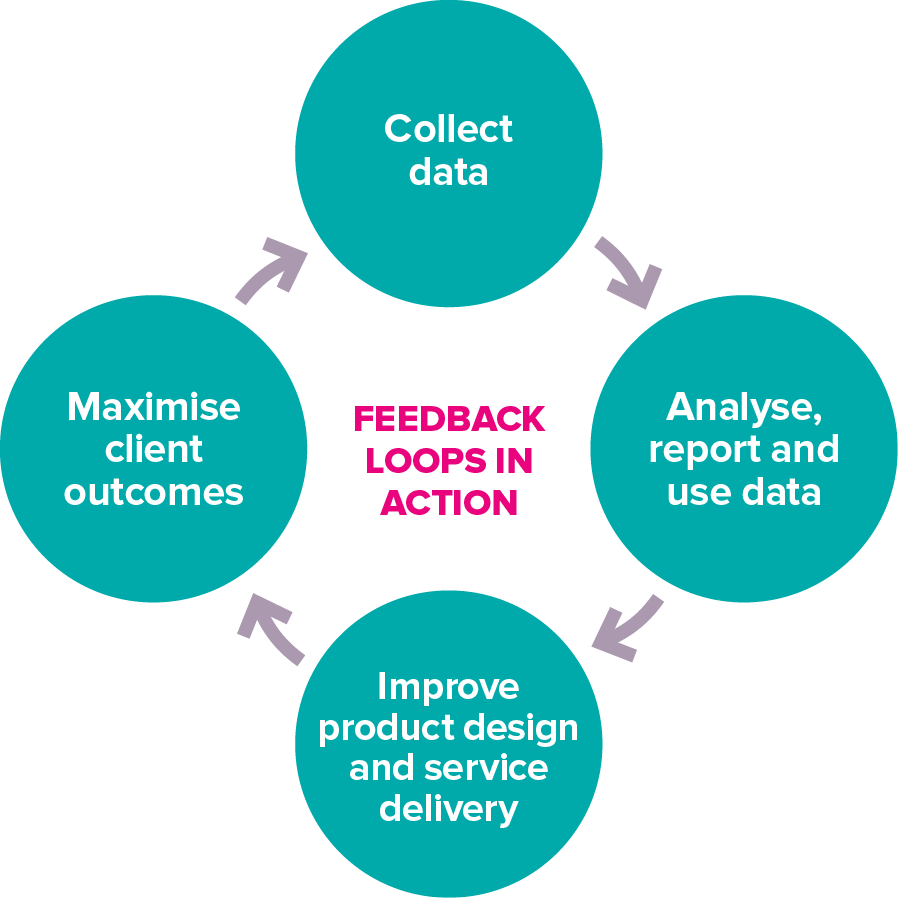

But as well as implementing best practices, it is important that financial service providers collect feedback from clients and act on that feedback to ensure that the financial services are meeting their needs and being provided as intended.

Collecting Feedback From Clients

Our partners use several different tools to collect feedback from clients including:

- Client Satisfaction Surveys

- Client Exit Surveys

- Complaint Mechanisms

Historically, Microfinance Institutions have focused on providing loans for income generating purposes. Over the years, many of our partners have extended the services they provide in response to the specific needs of the clients in their target areas. For example, four of our partners in India now provide loans for consumer durable goods, and three provide emergency loans.

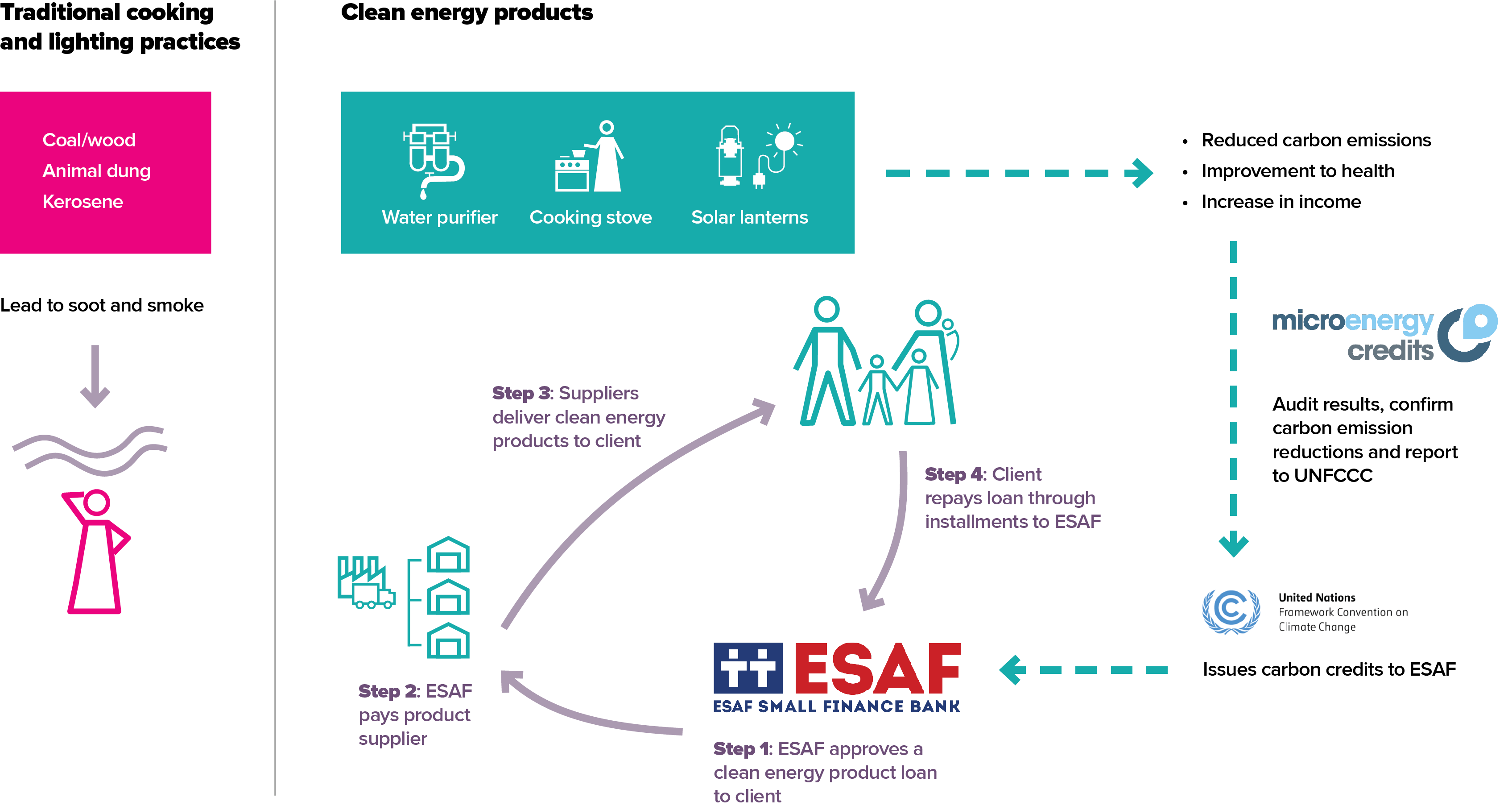

Our partner ESAF has provided Clean Energy Product loans to over 400,000 clients over the last 5 years. This responds to demand from clients for water purifiers, clean cooking stoves and solar lanterns, to replace unhealthy and inefficient traditional cooking and lighting methods.

Best Practices in Social Performance

The Client Protection Principles are the minimum standards that clients should expect to receive when doing business with a microfinance institution. These principles were distilled from years of service provision and research by providers, international networks, and national microfinance associations to develop client-focused codes of conduct and practices.

The 7 Client Protection Principles are:

- Appropriate product design and delivery

- Prevention of over-indebtedness

- Transparency

- Responsible pricing

- Fair and respectable treatment of clients

- Privacy of client data

- Mechanisms for resolution of client complaints

Opportunity works with our partners to help them implement these principles in their work and we encourage our partners to undergo independent third-party assessment of their policies and practices to ensure they uphold the highest standards of service provision.

Best practices for the industry are being continually reviewed and updated to ensure they are relevant to changing client needs and financial services. In 2022, SPTF will launch revised standards that will include new areas of best practice in environmental protection and the promotion of climate resilience. We will work with all of our partners to ensure that they can assess their organisations against these best practices and identify and address areas for improvement.

SPTF and CERISE launched a new gold/silver/bronze scheme for certifying MFIs in September 2021.

The Universal Standards for SPM build on the Client Protection Principles with additional standards of defining and monitoring social goals, ensuring Board, management and employee commitment to social goals, responsible treatment of employees and balancing financial and social performance.

The manual is organized into six different dimensions:

- Define and Monitor Social Goals

- Ensure Board, Management, and Employee Commitment to Social Goals

- Design Products, Services, Delivery Models and Channels That Meet Clients’ Needs and Preferences

- Treat Clients Responsibly

- Treat Employees Responsibly

- Balance Financial and Social Performance

Each dimension contains standards, which are simple definitions of what the institution should achieve, as well as essential practices, which are the management practices that the institution must implement in order to meet the standard. There are also one or more indicators per essential practice, which an institution can use to assess whether it has implemented the practice. Overall, meeting the Universal Standards signifies that an institution has strong social performance management (SPM) practices.

Best Practices - Working With Our Partners

The SPM team works with each of Opportunity’s partners to review key internal policies that govern how the organisation is run and how clients are treated. The following list of policies that we have supported partners with gives an idea of the extent of work done by our partners to ensure client protection and minimise risk of harm/malpractice:

Anti-Discrimination Policy Exclusion Policy

Anti-Sexual Harassment Policy Gender Policy

Child Protection Code of Conduct Grievance Policy

Child Protection Policy Health & Safety Policy

Staff Code Of Conduct Privacy Policy

Environment Policy Whistle-Blowing Policy

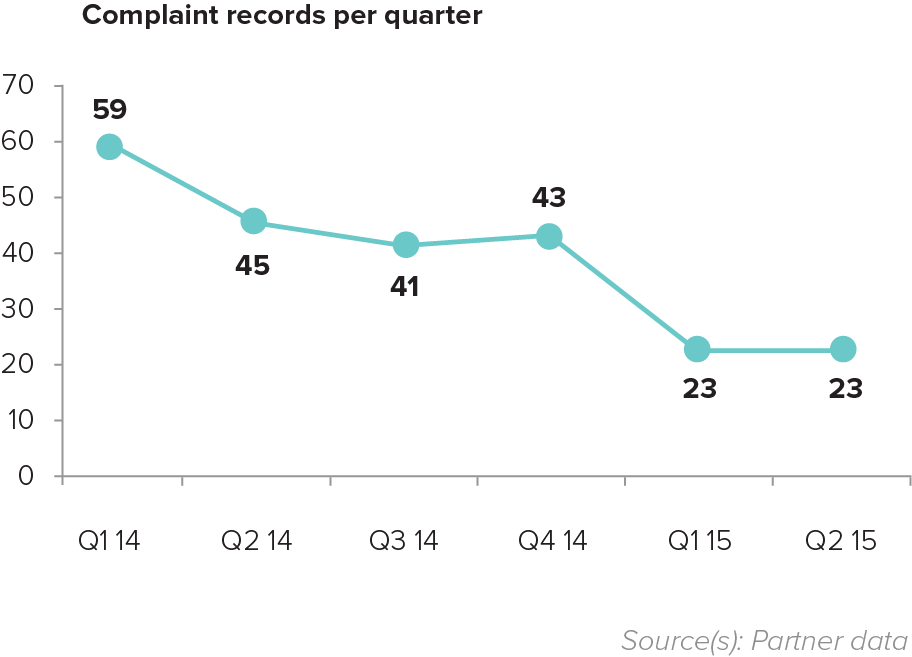

Best Practices in Action: Complaint Mechanisms

Industry best practices provide detail on policies, processes and practices that should be followed to ensure the best possible standard of service provision for low-income and vulnerable clients. For example, in order to be compliant with best practice in the area of “Mechanisms for resolution of client complaints”, the provider must:

One: Have an effective system in place to receive and resolve client complaints:

- Clients must be able to submit complaints to the provider through someone other than their main point of contact or that person's supervisor.

- Mechanisms to submit complaints must be adapted to clients' needs and preferences and easily accessible (toll free number, etc.). Suggestion boxes are not sufficient, and at least two channels must be available.

- Resolution of complaints must be prioritized based on their severity, and almost all complaints must be resolved within one month (some exceptions may be permitted due to complexity).

- There must be a clear and secure system in place so that complaints from branches and (if applicable) agents reach the provider's complaints handling staff and/or management.

Two: Use information from complaints to manage operations and improve product and service quality.

- Management must regularly review KPIs (e.g., percent resolved, average time to resolve) and take corrective action to resolve mis-handled cases and improve systematic shortcomings.

- Internal control process must ensure uniform application of policies and procedures for complaints handling, including review of a sample of cases.

- Complaints and their resolutions must be taken into account in staff bonuses or performance evaluations.

- The analysis of complaints data, satisfaction surveys and reason for drop-outs must contribute to improving operations and services.

- The provider's complaints handling training must cover how the complaints mechanism works, the role of complaints staff, how to appropriately manage complaints until they are resolved, and how to refer them to the appropriate person for investigation and resolution.

An external assessor will examine the provider’s policies, and will visit randomly chosen branches to ensure that these policies are being followed.